Adnan Adams Mohammed

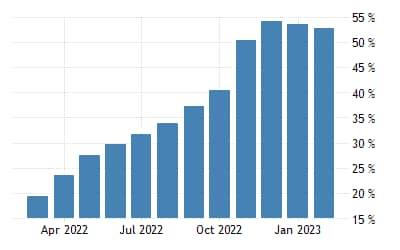

As global prices of food and energy ease, Ghanaians are likely to witness a positive improvement in its inflationary trends.

Ease in prices could have a trickle-down effect on Ghana’s economy, the Bank of Ghana Governor has said.

In spite of the emerging risks to global financial stability, central banks in major advanced economies have demonstrated a strong commitment to containing underlying inflationary pressures with sustained policy rate hikes, albeit, at lower rates than earlier anticipated”.

“Global inflation is easing as food and energy prices moderate due to weakened global demand, improved supply of goods, and continued monetary policy tightening”, Governor Dr Ernest Addison said at its recent Monetary Policy Committee meeting held in Accra last week.

“Global financing conditions have eased slightly, reflecting changing market expectations regarding the pace of policy tightening”.

The US dollar index initially firmed up amid rising demand for safe-haven currencies following the collapse of Silicon Valley Bank and Signature Bank, but so far, swift regulatory action and assurances to contain contagion risks, combined with decisions to boost dollar liquidity somewhat eased market concerns about a wider banking and financial crisis.

“The committee was of the view that the ease in price pressures abroad would likely impact positively on Ghana’s domestic inflation profile”, he reported.

On the other hand, he said “the committee noted that the domestic economy still faces relatively tight global financing conditions, emerging risks in the global financial system, and heightened uncertainty about the global economic outlook”.

“The effects of these on the domestic economy could be amplified by inherent vulnerabilities, including structural excess liquidity following the DDEP, and the widening negative output gap”, he added.